rental property worksheet pdf

Rental property worksheets are essential tools for tracking income, expenses, and tax-related details. Available as PDFs, they help landlords and investors organize financial data efficiently, ensuring compliance with tax requirements and streamlining property management tasks. These worksheets often include sections for gross rental income, operating expenses, and depreciation calculations, making them indispensable for accurate financial reporting and decision-making.

What is a Rental Property Worksheet?

A rental property worksheet is a detailed document designed to help landlords and property managers track and organize financial data related to their rental properties. It typically includes sections for recording rental income, expenses, and tax-deductible items, ensuring accurate financial reporting. Available in PDF format, these worksheets are customizable to suit individual needs, making them a practical tool for managing multiple properties. They often provide a comprehensive overview of income and expenses, helping users calculate net rental income and comply with tax requirements. By streamlining financial record-keeping, rental property worksheets simplify the process of monitoring property performance and making informed investment decisions.

Importance of Using a Rental Property Worksheet

Using a rental property worksheet is crucial for effectively managing rental properties and ensuring financial accuracy. It helps landlords and investors organize income and expenses, simplifying tax reporting and compliance. By tracking gross rents, operating costs, and depreciation, worksheets provide a clear overview of a property’s financial performance. This tool is essential for identifying profit margins, budgeting, and making informed investment decisions. Additionally, worksheets reduce errors in financial calculations and ensure adherence to tax regulations. Regular use of a rental property worksheet enhances transparency, accountability, and overall property management efficiency, making it an indispensable resource for anyone involved in rental real estate.

Components of a Rental Property Worksheet

A rental property worksheet typically includes sections for property details, rental income, expenses, and depreciation. It helps organize financial data for accurate reporting and tax compliance.

Property Details Section

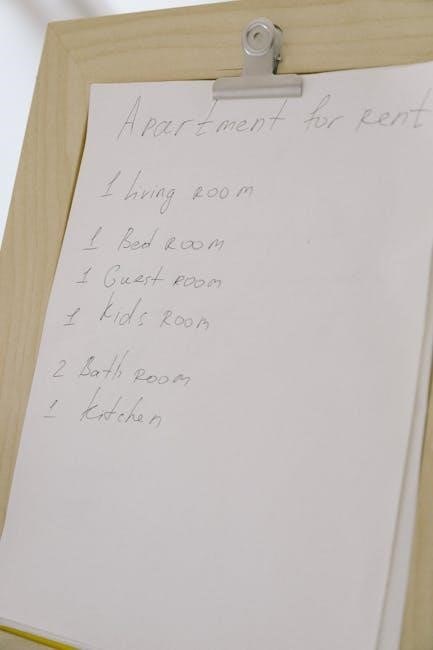

The Property Details Section of a rental property worksheet captures essential information about the rental property, including its address, type (residential/commercial), and acquisition date. It also lists the number of units, square footage, and property manager details. This section is crucial for maintaining accurate records and ensures that all relevant property-specific data is readily available. It helps in organizing information needed for tax filings, insurance purposes, and investment tracking. Additionally, it may include details about mortgages, such as lender information and loan balances. This section serves as the foundation for the rest of the worksheet, providing a clear overview of the property’s characteristics and financial obligations. Accurate completion of this section ensures seamless integration with other parts of the worksheet, such as income and expense calculations. It is vital for proper financial management and compliance.

Rental Income and Expenses Categories

The Rental Income and Expenses Categories section of a rental property worksheet categorizes all income earned and expenses incurred related to the property. Rental income includes monthly rent, lease options, and other income sources like parking or laundry fees. Expenses are divided into operating and capital categories, with operating expenses covering items like property management fees, maintenance, utilities, insurance, and property taxes. This section ensures that all financial transactions are organized and easily tracked. It helps property owners understand cash flow, profitability, and areas for cost reduction. Accurate categorization is essential for tax compliance and simplifies the process of completing tax forms. This section is a cornerstone of effective rental property financial management. It provides a clear breakdown of income and expenses, aiding in budgeting and financial planning.

Net Rental Income Calculation

Net Rental Income Calculation is a critical component of a rental property worksheet, providing a clear picture of the property’s profitability. It is determined by subtracting total operating expenses from gross rental income. Gross rental income includes all rent and other income sources, while operating expenses cover items like property management fees, maintenance, utilities, and insurance. This calculation helps property owners assess cash flow and profitability. Accurate net income figures are essential for tax reporting and investment analysis. By organizing income and expenses, this section simplifies financial decision-making. It also highlights whether the property is generating a profit or loss, enabling owners to adjust pricing or expense management strategies. This calculation is vital for evaluating the financial performance of a rental property and ensuring sustainable income generation.

Types of Rental Property Worksheets

Rental property worksheets vary by purpose, including basic, tax-focused, and investment analysis types, each tailored to specific financial and operational needs of property management.

Basic Rental Property Worksheet

A basic rental property worksheet is a straightforward tool designed for landlords to track essential financial data related to their rental properties. It typically includes sections for property details, rental income, and operating expenses, allowing users to calculate net income and monitor cash flow. This type of worksheet is ideal for small-scale property managers or those with limited portfolios, as it simplifies record-keeping and provides a clear overview of financial performance. The basic worksheet is often customizable, enabling users to tailor it to their specific needs. It serves as a foundational tool for budgeting, forecasting, and making informed decisions about property maintenance or tenant management; Its simplicity makes it accessible even for new landlords or those unfamiliar with complex financial spreadsheets.

Tax-Focused Rental Property Worksheet

A tax-focused rental property worksheet is specifically designed to help landlords and property managers organize financial data for tax purposes. It includes detailed sections for income, expenses, and deductions relevant to tax filings. This worksheet categorizes items like rental income, operating expenses, mortgage interest, property taxes, and depreciation. It also highlights tax-deductible expenses, ensuring compliance with IRS guidelines. The tax-focused worksheet often includes columns for annual totals and quarterly breakdowns, making it easier to prepare for tax season. By streamlining tax-related data, it reduces errors and ensures that all eligible deductions are claimed. This tool is particularly useful for landlords with multiple properties or those seeking to maximize tax savings. Its structured format aligns with IRS requirements, simplifying the tax reporting process.

Investment Analysis Rental Property Worksheet

An investment analysis rental property worksheet is a specialized tool designed to evaluate the financial performance and potential profitability of rental properties. It helps investors assess key metrics such as cash flow, return on investment (ROI), and capitalization rate (cap rate). This worksheet typically includes sections for annual rental income, operating expenses, and capital expenditures, allowing users to calculate net operating income and overall property valuation. It also enables comparisons between different investment opportunities, helping landlords make informed decisions. By organizing data like mortgage payments, appreciation, and tax benefits, this worksheet simplifies the process of evaluating whether a property is a viable investment. It’s an essential resource for both novice and experienced investors seeking to maximize returns and build a profitable portfolio. Its detailed analysis ensures data-driven decision-making.

Benefits of Using a Rental Property Worksheet

A rental property worksheet enhances organization, accuracy, and time efficiency in managing financial records. It simplifies tracking income, expenses, and tax obligations, ensuring informed decision-making and better profitability.

Streamlining Financial Record-Keeping

A rental property worksheet simplifies financial organization by centralizing income and expense data, reducing clutter and errors. It categorizes transactions clearly, making it easier to track monthly cash flow and identify trends.

This tool saves time by automating calculations and providing a structured format for recording rent payments, utility bills, and maintenance costs. By maintaining accurate records, landlords can quickly generate reports for budgeting or financial reviews.

Regular updates ensure transparency, helping users stay on top of their property’s financial health. This streamlined approach minimizes administrative burdens, allowing landlords to focus on improving property performance and profitability. A well-organized worksheet also supports better decision-making and long-term financial planning.

Ensuring Tax Compliance

A rental property worksheet is essential for maintaining tax compliance by accurately tracking income and expenses throughout the year. It helps categorize deductible expenses, such as property taxes, insurance, and repairs, ensuring no eligible deductions are missed.

The worksheet also accounts for depreciation and amortization, which are critical for accurate tax reporting. By organizing financial data in one place, landlords can easily complete tax forms like Schedule E and meet IRS requirements.

This tool reduces the risk of errors or omissions that could lead to audits or penalties. Regular updates ensure all transactions are documented, providing a clear audit trail. Proper tax compliance not only avoids legal issues but also maximizes tax savings, making a rental property worksheet indispensable for landlords.

Facilitating Investment Decisions

A rental property worksheet is a powerful tool for facilitating investment decisions by providing a clear financial overview of rental properties. It allows investors to evaluate the profitability of a property by analyzing rental income, operating expenses, and net income.

The worksheet also enables comparison between potential properties, helping investors make informed decisions. By calculating key metrics like cash flow and return on investment (ROI), it simplifies the process of assessing which properties align with financial goals.

Additionally, it supports scenario analysis, such as how rent increases or expense reductions might impact profitability. This data-driven approach reduces uncertainty, empowering investors to make strategic choices confidently. Regular updates ensure investors stay informed about market trends and property performance, aiding in long-term portfolio growth. As a result, a rental property worksheet is indispensable for investors seeking to maximize returns and build a profitable portfolio.

Tax Considerations for Rental Properties

A rental property worksheet helps investors manage tax obligations by tracking deductible expenses, depreciation, and income. It ensures compliance with IRS requirements and simplifies tax reporting, reducing errors.

Depreciation and Amortization

Depreciation and amortization are critical components in rental property taxation, allowing owners to deduct the cost of assets over their useful lives. Depreciation applies to tangible assets like buildings, while amortization covers intangible costs such as mortgage points or legal fees. For residential properties, depreciation is typically spread over 27.5 years using the straight-line method. Amortization periods vary based on the asset or agreement. These non-cash expenses reduce taxable income annually, providing significant tax benefits. A rental property worksheet helps track these deductions accurately, ensuring compliance with IRS regulations. Proper calculation of depreciation and amortization is essential to avoid overpaying taxes and to maintain precise financial records for reporting purposes. This ensures long-term tax efficiency and maximizes investment profitability.

Deductible Expenses

Deductible expenses for rental properties include costs incurred to maintain and operate the property. Common examples are mortgage interest, property taxes, insurance, repairs, utilities, and property management fees. These expenses reduce taxable income, lowering the overall tax liability. A rental property worksheet helps categorize and track these deductions accurately. Proper documentation ensures compliance with IRS guidelines, maximizing tax savings. It’s essential to differentiate between deductible operating expenses and capital expenditures, which are depreciated over time. Keeping detailed records in a worksheet simplifies tax reporting and ensures no eligible expenses are overlooked. Accurate tracking of these costs is vital for financial clarity and tax efficiency, benefiting both short-term cash flow and long-term investment performance.

Tax Forms and Reporting Requirements

Rental property owners must report income and expenses on specific tax forms to comply with IRS regulations. The primary form is Schedule E (Form 1040), where rental income, deductions, and credits are detailed. Net rental income from Schedule E is then reported on Form 1040. Additionally, Form 4562 is required if depreciation or amortization is claimed. If the property is sold, Form 4797 must be filed for gains or losses. A rental property worksheet helps organize data needed for these forms, ensuring accurate reporting. Records of income, expenses, and asset details must be maintained for at least three years in case of an audit. The deadline for filing is typically April 15, with extensions available. Proper use of a worksheet streamlines compliance with these tax reporting requirements, minimizing errors and penalties.

Common Expenses in Rental Property Worksheets

Rental property worksheets track operating, capital, and tax-deductible expenses. Operating expenses include utilities, maintenance, and property management fees. Capital expenses cover major purchases like appliances or renovations. Tax-deductible expenses include mortgage interest and property taxes, reducing taxable income. Accurate categorization ensures proper financial reporting and compliance with tax requirements.

Operating Expenses

Operating expenses in a rental property worksheet are the recurring costs incurred to manage and maintain the property. These include utilities, maintenance, and repairs. Property management fees, insurance, and property taxes are also categorized as operating expenses. Additionally, expenses like landscaping, pest control, and trash removal fall under this category. Tracking these expenses is crucial for accurate financial reporting and determining net rental income. Proper categorization ensures compliance with accounting standards and helps in identifying areas for cost reduction. By monitoring operating expenses, landlords can optimize their property’s financial performance and ensure long-term profitability. This section of the worksheet provides a clear overview of ongoing expenditures, essential for budgeting and financial planning.

Capital Expenses

Capital expenses in a rental property worksheet refer to significant, long-term investments made to improve or maintain the property. These include major repairs, renovations, or purchases that increase the property’s value or extend its useful life. Examples are installing a new roof, replacing HVAC systems, or upgrading plumbing. Unlike operating expenses, capital expenses are not immediately deductible but are depreciated over time. Tracking these expenses is essential for accurate financial records and tax reporting. They are recorded separately in the worksheet to reflect their long-term impact on the property’s value. Proper documentation of capital expenses ensures compliance with accounting standards and helps in calculating depreciation. This distinction is vital for landlords to manage their finances effectively and make informed investment decisions.

Tax-Deductible Expenses

Tax-deductible expenses in a rental property worksheet are costs incurred to generate rental income and can be subtracted from taxable income. These include mortgage interest, property taxes, insurance, maintenance, and repairs. Utilities, property management fees, and advertising costs are also deductible. Expenses must be ordinary and necessary for managing the property. For example, travel expenses to inspect the property or collect rent may qualify. However, personal expenses or capital improvements are not deductible. Accurate categorization of these expenses is crucial for tax compliance and maximizing deductions. Landlords should maintain detailed records to support their deductions and ensure they meet IRS guidelines. Proper documentation helps avoid disputes and ensures optimal financial management. This section is vital for minimizing tax liabilities and maximizing profitability.

Calculating Rental Income

Rental income calculation involves determining gross rental income from tenants, including monthly rents and other related income sources like parking or laundry fees, ensuring accurate financial tracking.

Gross Rental Income

Gross rental income represents the total rental revenue earned from a property before any deductions or expenses. It includes monthly rents, lease agreements, and other consistent income streams. This figure is crucial for assessing the property’s financial performance and is typically the starting point for calculating net rental income. Gross rental income also encompasses additional sources, such as parking fees, laundry income, or vendor payments, if applicable. Accurate calculation of gross rental income is essential for tax reporting and financial planning. A rental property worksheet often includes a section dedicated to tracking and categorizing gross rental income, ensuring all revenue streams are accounted for. This step is foundational for determining profitability and compliance with tax obligations.

Other Related Income

Other related income includes revenue generated from sources beyond base rental payments, such as parking fees, laundry facilities, or vending machines. This income is tracked separately in a rental property worksheet to ensure it is accounted for in financial calculations. It also includes income from subletting portions of the property or fees for additional services like pet deposits. This category helps property owners recognize all revenue streams tied to the property. Accurate documentation of other related income is essential for tax reporting and financial planning. It also provides insights into potential revenue growth opportunities. By categorizing this income, property managers can better assess the property’s overall profitability and make informed decisions. This section ensures no additional income sources are overlooked in financial assessments.

Adjustments to Gross Income

Adjustments to gross income in a rental property worksheet account for deductions or reductions in rental revenue. Common adjustments include rent concessions, such as discounts offered to tenants, or unpaid rent that must be written off. Security deposit deductions, if applicable, are also recorded here. Additionally, vacancy allowances, which estimate potential lost income due to unoccupied units, are factored in. These adjustments ensure that the final income figure reflects the actual rent collected, providing a clearer picture of the property’s financial performance. Accurate tracking of these adjustments is crucial for tax compliance and financial reporting. They help property owners understand the true profitability of their rental property by distinguishing Between gross potential income and net operating income. Proper documentation of these adjustments is essential for maintaining accurate records and making informed financial decisions. This section ensures transparency in income calculations and supports long-term property management strategies. It also highlights areas for potential income improvement and expense reduction. By documenting these adjustments, property owners can better assess their rental property’s financial health and plan accordingly. This step is vital for both tax purposes and overall investment evaluation. It ensures that all income adjustments are properly accounted for, avoiding discrepancies in financial statements. Adjustments to gross income are a critical component of a comprehensive rental property worksheet, offering insights into the property’s actual cash flow. They help in identifying trends and patterns that may impact future rental income projections. This data is invaluable for budgeting, forecasting, and making strategic decisions. By carefully recording these adjustments, property owners can optimize their rental income and maintain financial stability. It also aids in comparing performance across multiple properties, if applicable. This section is a cornerstone of effective rental property management, ensuring that all income-related factors are considered. Adjustments to gross income provide a detailed and accurate representation of a property’s earnings, enabling owners to make data-driven decisions. They are a fundamental part of maintaining precise financial records and ensuring compliance with tax regulations. Properly documenting these adjustments is essential for the overall success of rental property management. It allows owners to track every dollar earned and understand the factors influencing their income streams. This level of detail is indispensable for maximizing profitability and achieving long-term financial goals. Adjustments to gross income are a key feature of a well-structured rental property worksheet, offering clarity and precision in financial reporting. They enable property owners to make informed decisions and maintain a healthy financial standing. This section is a vital tool for managing rental properties effectively and efficiently. By incorporating adjustments to gross income, the worksheet provides a comprehensive view of the property’s financial situation, helping owners navigate the complexities of rental income management. It is a critical element in achieving financial accuracy and ensuring the sustainability of rental investments. Adjustments to gross income are a cornerstone of effective rental property management, offering insights that drive decision-making and financial success. They are a testament to the importance of meticulous record-keeping in the rental property business. This section underscores the need for precision in tracking income adjustments, ensuring that all factors are considered. It is a fundamental aspect of maintaining accurate financial records and achieving long-term profitability. Adjustments to gross income are a vital component of a rental property worksheet, providing a detailed and accurate representation of a property’s earnings. They are essential for tax compliance, financial planning, and investment analysis. This section is a key part of managing rental properties successfully, enabling owners to make informed decisions and optimize their income streams. Adjustments to gross income are a critical feature of a comprehensive rental property worksheet, ensuring that all revenue adjustments are properly documented and considered. They are a fundamental tool for achieving financial clarity and maximizing profitability in rental property management. This section is indispensable for property owners seeking to maintain precise financial records and make data-driven decisions. Adjustments to gross income are a cornerstone of effective rental property management, offering valuable insights into a property’s financial performance. They are essential for ensuring accuracy in financial reporting and compliance with tax requirements. This section is a vital part of the rental property worksheet, providing a detailed account of all income adjustments. It is a critical tool for property owners aiming to optimize their rental investments and achieve long-term financial success. Adjustments to gross income are a key element in the rental property worksheet, ensuring that all revenue adjustments are accurately recorded and reflected in financial calculations. They are essential for maintaining transparency and precision in rental income management. This section is a fundamental aspect of effective property management, enabling owners to make informed decisions and achieve their financial goals. Adjustments to gross income are a vital component of a rental property worksheet, offering a comprehensive view of a property’s earnings and financial health. They are essential for tax compliance, financial planning, and investment analysis. This section is a cornerstone of successful rental property management, providing insights that drive decision-making and financial success; Adjustments to gross income are a critical feature of a rental property worksheet, ensuring that all revenue adjustments are properly documented and considered. They are a fundamental tool for achieving financial clarity and maximizing profitability in rental property management. This section is indispensable for property owners seeking to maintain precise financial records and make data-driven decisions. Adjustments to gross income are a cornerstone of effective rental property management, offering valuable insights into a property’s financial performance. They are essential for ensuring accuracy in financial reporting and compliance with tax requirements. This section is a vital part of the rental property worksheet, providing a detailed account of all income adjustments. It is a critical tool for property owners aiming to optimize their rental investments and achieve long-term financial success. Adjustments to gross income are a key element in the rental property worksheet, ensuring that all revenue adjustments are accurately recorded and reflected in financial calculations. They are essential for maintaining transparency and precision in rental income management. This section is a fundamental aspect of effective property management, enabling owners to make informed decisions and achieve their financial goals. Adjustments to gross income are a vital component of a rental property worksheet, offering a comprehensive view of a property’s earnings and financial health. They are essential for tax compliance, financial planning, and investment analysis. This section is a cornerstone of successful rental property management, providing insights that drive decision-making and financial success. Adjustments to gross income are a critical feature of a rental property worksheet, ensuring that all revenue adjustments are properly documented and considered. They are a fundamental tool for achieving financial clarity and maximizing profitability in rental property management. This section is indispensable for property owners seeking to maintain precise financial records and make data-driven decisions. Adjustments to gross income are a cornerstone of effective rental property management, offering valuable insights into a property’s financial performance. They are essential for ensuring accuracy in financial reporting and compliance with tax requirements. This section is a vital part of the rental property worksheet, providing a detailed account of all income adjustments. It is a critical tool for property owners aiming to optimize their rental investments and achieve long-term financial success. Adjustments to gross income are a key element in the rental property worksheet, ensuring that all revenue adjustments are accurately recorded and reflected in financial calculations. They are essential for maintaining transparency and precision in rental income management. This section is a fundamental aspect of effective property management, enabling owners to make informed decisions and achieve their financial goals. Adjustments to gross income are a vital component of a rental property worksheet, offering a comprehensive view of a property’s earnings and financial health. They are essential for tax compliance, financial planning, and investment analysis. This section is a cornerstone of successful rental property management, providing insights that drive decision-making and financial success. Adjustments to gross income are a critical feature of a rental property worksheet, ensuring that all revenue adjustments are properly documented and considered. They are a fundamental tool for achieving financial clarity and maximizing profitability in rental property management. This section is indispensable for property owners seeking to maintain precise financial records and make data-driven decisions. Adjustments to gross income are a cornerstone of effective rental property management, offering valuable insights into a property’s financial performance. They are essential for ensuring accuracy in financial reporting and compliance with tax requirements. This section is a vital part of the rental property worksheet, providing a detailed account of all income adjustments. It is a critical tool for property owners aiming to optimize their rental investments and achieve long-term financial success. Adjustments to gross income are a key element in the rental property worksheet, ensuring that all revenue adjustments are accurately recorded and reflected in financial calculations. They are essential for maintaining transparency and precision in rental income management. This section is a fundamental aspect of effective property management, enabling owners to make informed decisions and achieve their financial goals. Adjustments to gross income are a vital component of a rental property worksheet, offering a comprehensive view of a property’s earnings and financial health. They are essential for tax compliance, financial planning, and

Practical Uses of a Rental Property Worksheet

A rental property worksheet is a versatile tool for property valuation, budgeting, and forecasting. It aids in comparative analysis of multiple properties, ensuring informed investment decisions and optimal resource allocation.

- Property Valuation and Appraisal

- Budgeting and Forecasting

- Comparative Analysis of Multiple Properties

These practical uses streamline property management, enhance financial planning, and support data-driven decision-making for landlords and investors.

Property Valuation and Appraisal

A rental property worksheet is instrumental in property valuation and appraisal by providing a clear financial snapshot. It organizes income, expenses, and cash flow, enabling accurate property worth assessment for taxation or investment. This tool simplifies comparing properties, aiding in informed decisions.

The standardized format ensures consistency in data presentation, crucial for precise valuations. By analyzing rental income and expenses, the worksheet helps identify a property’s market value, supporting tax assessments and investment strategies effectively.

Budgeting and Forecasting

A rental property worksheet is a powerful tool for budgeting and forecasting, enabling property managers to anticipate future financial scenarios. By categorizing income and expenses, it simplifies the creation of detailed budgets. This helps in allocating resources effectively and identifying potential cost-saving opportunities. Forecasting features allow users to project rental income and expenses over specific periods, ensuring preparedness for market fluctuations. The worksheet also highlights trends, aiding in long-term financial planning. With accurate data, property owners can make informed decisions to optimize profitability and maintain financial stability. This tool is essential for balancing short-term needs with long-term investment goals, ensuring sustainable growth in rental property management.

Comparative Analysis of Multiple Properties

A rental property worksheet is invaluable for conducting a comparative analysis of multiple properties, allowing investors to assess performance across their portfolio. By organizing data such as rental income, expenses, and net income for each property, users can easily compare profitability. This analysis helps identify top-performing properties and those requiring improvement. The worksheet enables side-by-side comparisons of key metrics like occupancy rates, operating costs, and cash flow. Such insights empower investors to allocate resources effectively, prioritize maintenance, and strategize for future investments. Additionally, it aids in evaluating market trends and making data-driven decisions to maximize returns. This feature is crucial for managing diverse rental assets and ensuring overall portfolio success.